- Products

- Solutions

- Learn

- Partner

- Try Now

The landscape is evolving, and it’s changing fast with the rise of new UK retail trends in 2022. Some changes have been on the horizon for a long time, and others have been driven by the pandemic. Shops were forced to close their doors for months on end.

Consumers were stuck at home with time on their hands, and they had to find a new way to shop for essentials and luxuries. This perfect storm of events has driven some major changes in the retail landscape that is here to stay.

In this article, we will discuss five UK retail trends in 2022 that are disrupting the way things have always been done. Businesses that are slow to adapt will find themselves left behind. Let’s take a closer look at each of these trends:

Omnichannel Takeover

It’s no secret that online shopping has been rising for a while now. In fact, UK consumers are some of the most prolific online shoppers in the world. And with good reason – it’s convenient, easy, and often cheaper than shopping in brick-and-mortar stores.

However, some holdouts still prefer to do their shopping in person. But even they are starting to come around, as evidenced by the recent surge in popularity of click-and-collect services. With the writing on the wall for the rise of digital stores, it’s only a matter of time before they become the dominant force in retail.

The pandemic has only accelerated this trend. People have been forced to shop online for everything from groceries to clothes and even furniture.

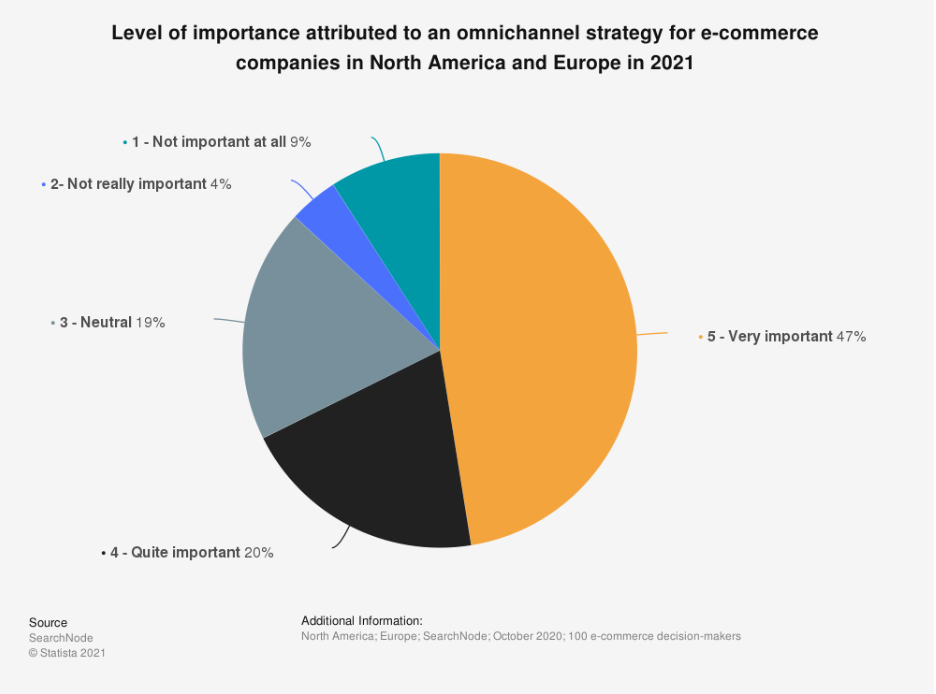

With more people turning to online shopping, businesses that don’t have an omnichannel strategy will find themselves at a disadvantage. Omnichannel is all about providing a seamless customer experience, whether the customer is shopping online, in-store, or through a mobile app.

The biggest retail stores such as Morrisons, ASDA, Sainsbury’s, and Tesco have worked on their omnichannel strategy for years. Customers can shop in-store, order on the web through an app, book a delivery slot, and obtain their groceries through click and collect. This is no small task. It requires implementing in-store logistics, cross-channel tracking, and even an omnichannel contact centre to give the consumer more choice and flexibility to shop the way they want.

For businesses just getting started with their digital transformation process, you’ll need to learn how the law affects things. There are many regulations and laws to consider, such as GDPR and ePrivacy Directive (aka EU Cookie Law) each of which has its own strict guidelines on data and cookie use.

In simplest terms, Cookies are small fragments of data that store information when you go to a site and are used to track consumers’ movements for marketing and monitoring. Cookies allow websites to generate a unique user experience by helping understand the shopper’s profile, how they shop, what kind of retail they shop for, and different brands. However, a business needs to make sure they have obtained customers’ consent before the use of cookies. The EU Cookie Law monitors businesses’ use of cookies, but in recent years, there has been an increasing demand for stricter regulations involving browser cookies and consent requirements.

In order to save yourself time from creating a cookie policy from scratch and having to do a deep dive into data privacy laws, enlist the help of a cookie consent tool as an all-in-one solution for handling cookies. A cookie consent tool will scan your website for cookies, generate a customizable cookie policy that addresses data laws and compliances, create a cookie consent banner for your pages, and track and store customers’ consent.

Bypassing the Middleman (Direct to Consumer)

Another 2022 trend that has been accelerated by the pandemic is the move away from traditional retail channels such as department stores and supermarkets. UK consumers are increasingly turning to direct-to-consumer (DTC) brands that sell their products online or through a mobile app.

The reason for this is simple — DTC brands offer a better customer experience, often at a lower price point. UK consumers are savvy shoppers, and they’re not afraid to shop around for the best deal.

Social media has changed the way we interact with brands. In the past, we would see an advert on TV or in a magazine and then go out to buy the product. Now, with social media, we are much more likely to see an advert for a product and then go online and research it.

We might read reviews, watch YouTube videos, listen to Instagram influencers or even look at the brand’s social media pages before deciding. This is especially true for younger consumers who have grown up with social media. Brands that can build a strong emotional connection with their customers are more likely to succeed.

This is because we are more likely to buy from brands that we feel connected to on an emotional level. DTC brands are very good at using social media to build these emotional connections. As a result, they are becoming increasingly popular with UK consumers.

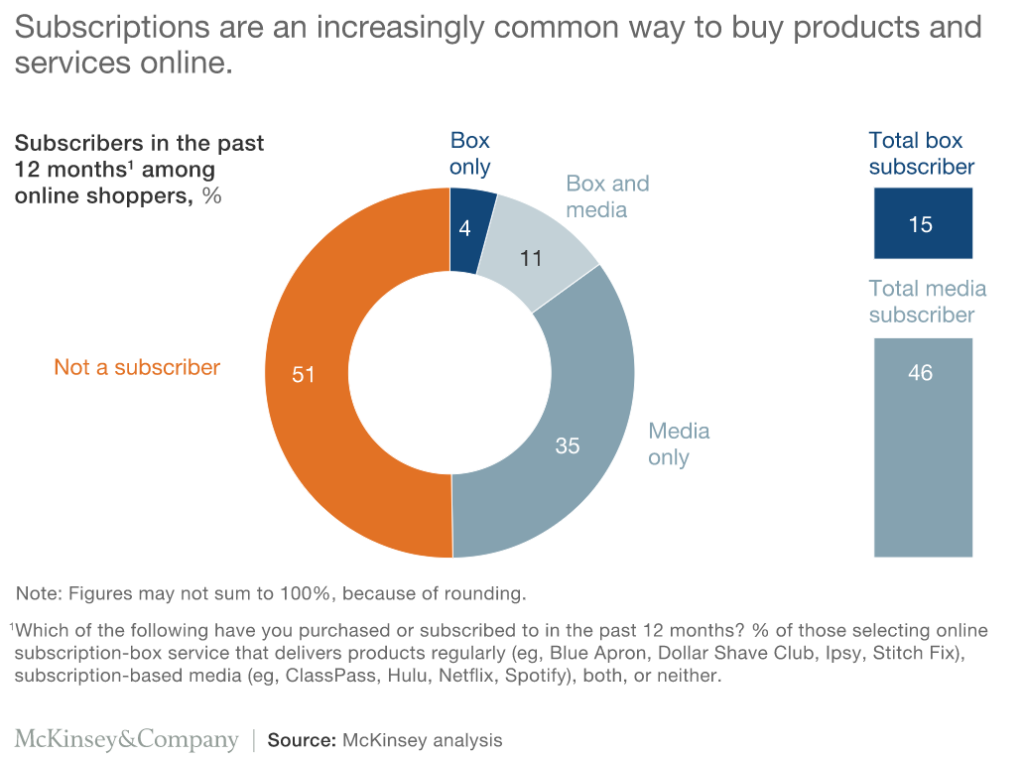

DTC brands such as Dollar Shave Club, HelloFresh, and Birchbox are seeing huge success in the UK market. These startups are breaking into traditionally hard markets by offering a more convenient service. More people are working, which leaves less time for homesteading. By automating the replenishment of essentials, consumers win back some of their time that can be spent with loved ones.

Traditional retailers can get in on this rising trend by launching their own DTC offerings. UK consumers are looking for convenience and value, so businesses must be able to provide both. Morrisons saw the popularity behind meal kits and launched their own Eat Fresh weekly box.

Smaller retailers like Ohh Deer, a stationery shop, looked at their unique selling proposition (USP) and launched their own subscription boxes. Now their customers can get a monthly/quarterly curated box of goods, and Ohh Deer have a recurring revenue stream and no middlemen to pay out to.

Growth with Recurring Revenue

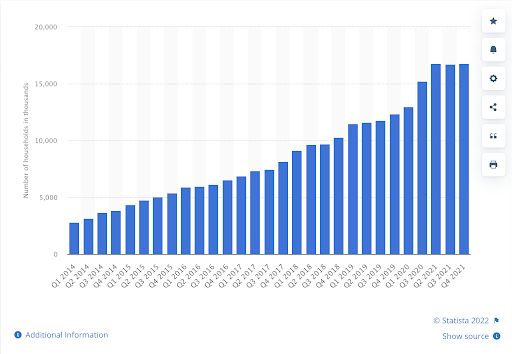

Recurring revenue models have been rising for a while now, driven by the Software-as-a-Service business models. UK consumers are increasingly turning to subscription-based services for everything from food delivery to streaming entertainment. 16.8 million households are signed up to Netflix, paying up to £15.99 a month to access its library.

This trend is driven by the UK’s move to a digital-first economy. Consumers are increasingly reliant on the internet for everything from work collaboration tools to entertainment streaming platforms. UK consumers are comfortable paying for access to services they use daily.

The perceived value needs to be high for a subscription service to work. While consumers are willing to pay extra for the added convenience, they will abandon a service that does not deliver the value they expect.

However, a service that solves a problem for its customers at a reasonable price can retain high loyalty. As a result, we are seeing a boom in subscription-based businesses. Businesses that can offer a convenient and affordable service that UK consumers use regularly are well-positioned for success.

Rethinking the old ways of Hiring

The pandemic has had a significant impact on the UK labour market. The hospitality and retail sectors have been hit hard, with many businesses closing their doors permanently. Job vacancies were eliminated in many sectors as firms were forced to reevaluate their hiring needs.

Staff was furloughed where appropriate, but some of these positions were made redundant as businesses adapted to the new normal. For companies that survived the pandemic, growth was expected to be slow. However, the UK had an impressive bounceback, which meant vacancies were being posted at breakneck speed.

There are more job vacancies than people looking for work. And those that are searching for jobs want more than just a paycheck. UK workers are looking for jobs that offer flexible hours, good working conditions, and the opportunity to learn new skills.

It is becoming increasingly challenging for retailers to fill job vacancies as the demand for retail workers has soared post-pandemic. Employers are now offering higher wages and benefits to find suitable workers. Offering to cover relocation expenses for new employees will become more common — increasing the cost per hire but providing retailers with access to a wider talent pool.

Transforming delivery

The shift to online shopping has put pressure on retailers to up their delivery game. Consumers now expect to be able to have their purchases delivered quickly and cheaply, and that’s putting pressure on retailers to up their game.

In response, we’ve seen a lot of innovation in the delivery space, with companies like Amazon leading the way. We’re now seeing same-day delivery becoming the norm in some cities across the country.

In order to meet the demand for fast and convenient delivery, retailers have had to invest in new technologies and logistics solutions. Many have turned to micro-fulfillment centers to handle the last mile of their deliveries. Not only can this help to reduce delivery overheads, but it increases how quickly goods can be with the customer.

It’s also common for retailers to partner with delivery companies to handle their deliveries. This can help take the pressure off of the retailer as the delivery partner will have an established and robust network.

Conclusion

The UK retail trends are changing the landscape rapidly. Consumer habits and expectations are evolving, and that’s having a major impact on how businesses operate. Retailers need to be agile and adaptable to survive in this ever-changing environment.

Those that can provide a convenient and affordable service that UK consumers use regularly are well-positioned for success. Hiring troubles may persist as the demand for retail workers has soared post-pandemic. And retailers must invest in new technologies and logistics solutions like Tookan to meet the demand for fast and convenient delivery.

Subscribe to stay ahead with the latest updates and entrepreneurial insights!

Subscribe to our newsletter

Get access to the latest industry & product insights.